The Royal Flush of Benchmarks: Online Gambling Metrics

The online gambling market is one of the most competitive out there. With hundreds of brands, each offering attractive welcome offers – the fight to attract and retain customers is fierce.

So who’s winning? Using Similarweb’s powerful data and research intelligence, we examined key digital insights from the online gambling industry; including traffic share, audience demographics, marketing channel performance, and more, to see the market leaders worldwide, and by individual countries too.

Our 2022 data shows that visits to gambling sites have dropped in the last year, so benchmarking your performance against major competitors can give you the insights you need to get ahead in the market. So, let’s dive in…

Methodology and competitive players

In order to give you the most accurate overview of the online gambling industry, we’ll showcase competitive benchmarking for the top 10 gambling websites worldwide, as well as in the U.K. and Germany. A majority of the data analyzed has been collected over the past year (February 2021 – February 2022).

Each competitive set consists of the following:

Top 10 gambling websites worldwide:

- Bet365.com

- caliente.mx

- bet9ja.com

- verajohn.com

- bovada.lv

- nesine.com

- bitcasino.com

- skybet.com

- betway.com

- platincasino.com

Top 10 gambling websites in the U.K:

- bet365.com

- skybet.com

- williamhill.com

- ladbrokes.com

- paddypower.com

- coral.co.uk

- skyvegas.com

- betfair.com

- virgingames.com

- betfred.com

Top 10 gambling websites in Germany:

- platincasino.com

- tipico.de

- interwetten.de

- bwin.de

- bet365.de

- jackpot.de

- energycasino.com

- tipbet.com

- bet-at-home.de

- 22bet.com

1. Total visits over time

Interest in online gambling has decreased over the past year. Total visits to the top 10 websites worldwide declined by just over 12% year-over-year (YoY) from 753 million in February 2021 to 660.2 million in February 2022.

2. Traffic share split – where do you fit in?

Understanding the traffic share split among top competitors in your industry will help you spot opportunities to win customers away from others. Keeping a digital scorecard of your competitive arena gives you a good idea of which websites gamblers prefer, and can also be an important indicator of up-and-coming industry players to watch, as well as those who may be losing popularity.

Take a look at the traffic share split for the top gambling websites worldwide, in the U.K., and Germany. Do you see any opportunities for growth?

Worldwide

Bet365.com is the most popular gambling site worldwide, with a whopping 39.7% of the traffic share. Caliente.mx comes in second with 23.8%, and bet9ja.com slides into the third spot with 16.6%.

The U.K.

Bet365.com comes in first again with 24.0% of the total traffic share for gambling websites in the U.K., followed closely by skybet.com (16.4%) and williamhill.com (12.7%).

Traffic split is divided more evenly among the top ten websites in the U.K. compared to worldwide. This means that there is more competition at a local level, with smaller companies vying against each other to win audience engagement.

Germany

Platincasino.com has a huge monopoly on the online gambling space in Germany with 39.2% of the traffic share. For comparison, its closest competitors tipico.de and interwetten.de have 23.3% and 12.4% of the traffic share respectively.

3. Measuring user engagement

For online gambling websites, visitors’ on-site user experiences are crucial for success. Benchmarking metrics such as bounce rate, click-through rate, page views and more gives you an idea of how much your users engage with your content compared to your competitors. You can also predict how well certain ads will perform. More time spent on a page means more opportunities to click.

Below are engagement metric benchmarks worldwide, in the U.K., and Germany, from February 2021 to February 2022.

Top 10 gambling websites worldwide

- Monthly visits: 792.4 million

- Average visit duration – 6m 49s

- Average pages per visit – 5.0

- Average bounce rate – 47.6%

Top 10 gambling websites in the U.K.

- Monthly visits: 118.2 million

- Average visit duration – 12m 17s

- Average pages per visit – 7.6

- Average bounce rate – 31.5%

Top 10 gambling websites in Germany

- Monthly visits: 40.2 million

- Average visit duration – 4m 36s

- Average pages per visit – 3.9

- Average bounce rate – 57.1%

Gambling websites in the U.K. have the best user experience overall, with considerably higher visit duration and page views when compared to Germany and the rest of the world. There is also a much lower bounce rate in the U.K., which means that gamblers there are browsing through multiple pages of a website before leaving.

4. Defining your audience

Understanding your target audience is key to smart content production, marketing campaigns, and website engagement. You can analyze the demographics of your main competitors to see who your customers most likely are.

Ten countries make up approximately 80% of the total market share for the top 10 gambling websites worldwide. Brazil brings in the most users with 21.1% of the traffic share or 91.1 million visits in three months. Mexico and Nigeria come in a close second and third respectively.

Worldwide, males are nearly twice as likely to visit gambling websites than females. Age distribution for this industry skews younger globally, with 63% of the audience falling between 18–34 years old, and 37% 35+ years old.

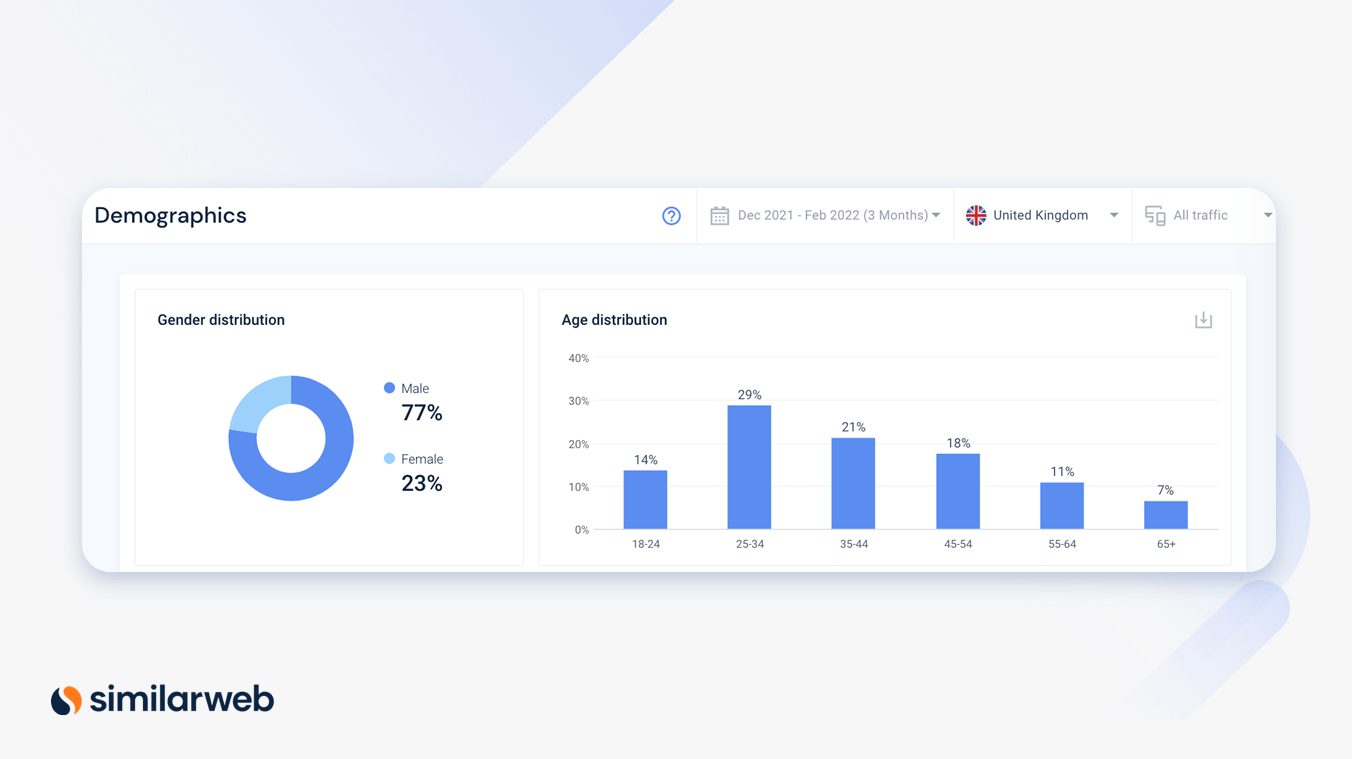

The gender split is even more apparent in the U.K. where 77% of the visits to gambling sites are male, while only 23% are female. And the audience skews slightly older compared to the worldwide benchmark.

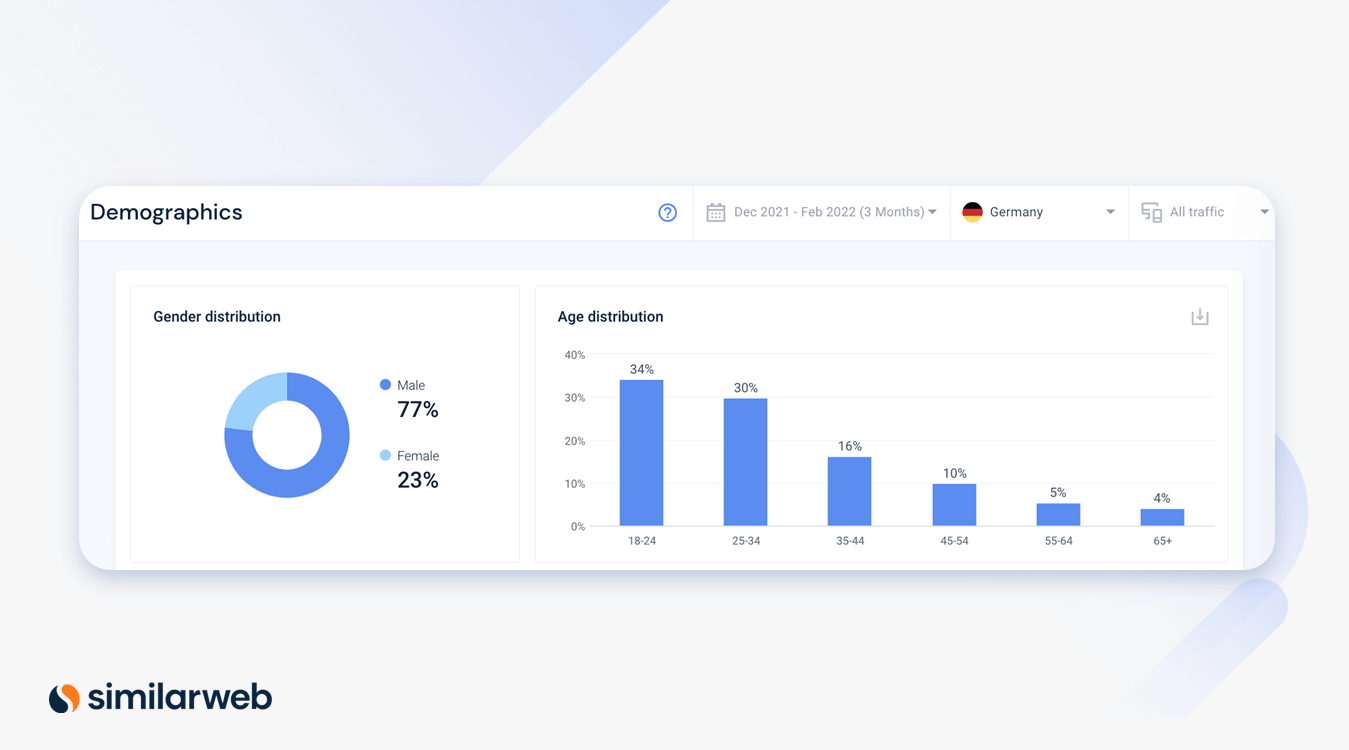

Lastly, when looking at Germany, the gender split follows the same trend as the U.K., with considerably more male visitors. Age distribution in Germany aligns with patterns we see worldwide.

5. Why device split matters

Benchmarks for device split offer an understanding of where you need to focus your marketing efforts when it comes to content creation, user experience, and ad spend.

For the top gambling websites across the globe, we see that most traffic comes from mobile. Make sure your website has a good user experience across all different types of mobile devices and mimics the same layout or user flow as your desktop version. If you aren’t already doing so, consider offering an app version of your website to increase user engagement.

Top 10 websites worldwide

- Desktop – 20.5% in 2022 (vs. 20.2% in 2021)

- Mobile – 79.5% in 2022 (vs. 79.8% in 2021)

Top 10 websites in the U.K.

- Desktop – 22.9% in 2022 (vs. 23.3% in 2021)

- Mobile – 77.1% in 2022 (vs. 76.7% in 2021)

Top 10 websites in Germany:

- Desktop – 31.2% in 2022 (vs. 28.8% in 2021)

- Mobile – 68.8% in 2022 (vs. 71.2% in 2021)

6. Benchmarking acquisition sources

Compare the performance benchmarks for your marketing channels and acquisition sources to see where you might be lagging compared to your competitors. You can also look at shifts over time to see how you can update your content strategy based on new consumer trends or interests.

Direct (65.8%) is the main source of traffic to the top gambling websites worldwide, followed by referrals (13.3%) and display ads (10.9%) This is proof of the importance of having both a loyal fanbase and strong brand awareness, as well as a smart paid acquisition strategy.

Both Germany and the U.K. mimic the global performance of marketing channels. However, gambling websites in the U.K. rely more on organic search and less on display ads. This information is useful when informing the marketing strategies for new product launches or entering a new market.

Stop guessing

By benchmarking your performance against your competitors, you’ll be able to create a more effective research strategy, ultimately setting yourself up for long-term success.

With Similarweb, you can collect benchmarking data, website analytics, competitive insights, and more, so that you never miss a beat or the opportunity to outshine your competitors. Create a free account and get started today.

Benchmark like a boss with fresh competitive data

Contact us to set up a call with a market research specialist